Real estate investing can be a powerful tool for building long-term wealth, especially through rental properties. If you’re considering buying a single-family home as a rental investment, it’s critical to understand how to analyze a rental property to ensure it’s a sound financial decision. This guide will walk you through the fundamentals of analyzing a single-family rental property.

Table of Contents

There are several ways to get started in owning rental property, I started by moving out of my first home which I bought with an FHA loan and converting it into a rental property. Instead of selling the home, I chose to rent it out and have someone else add to my wealth building strategy.

Set Your Investment Goals

Before you start running numbers, clarify your investment goals. Are you investing for monthly cash flow, long-term appreciation, or a combination of both? All my investments in real estate have been for the long-term appreciation. Wealth building with real estate is a good strategy but it takes a little know how and determination.

Do you plan to hold the property for decades, flip it in a few years, or convert it to a short-term rental? Your goals will shape your property selection, financing, and management approach. I managed my first rental property and will discuss that in another article. In latter articles I’ll discuss how I bought 10 properties in one year and closed on 7 of them.

Understand Key Investment Metrics

Here are the essential numbers every investor should know. I touch on these briefly and go into more detail in other articles, but you should start to become familiar with these terms as they’re used by those in the investment real estate industry.

Capitalization Rate (Cap Rate):

Net Operating Income (NOI) divided by the purchase price. It indicates the return on investment before financing. Let’s say that you’re looking at a property with the following scenario: A purchase price or cost of $300,000, and it generates $24,000 in gross rental income, and has $6,000 in annual operating expenses, excluding the mortgage.

To Calculate the Net Operating Income, or (NOI) as it’s often referred to by the industry, you would first subtract the operating expenses from the annual gross income. We take the $24,000 minus $6,000 to get the net operating income of $18,000. Next divide this NOI of $18,000 into the purchase price of $300,000 and multiply by 100 to get the percentage or cap rate.

$18,000 divided into our $300,000 purchase price gives us 0.06, which when multiplied by 100, gives us a cap rate of 6%.

I think of it like this. I invested $300,000 to receive $18,000 in net operating income, which gives me 6% before servicing the mortgage.

Cap Rate Example

You’re analyzing a rental property that:

- Costs $300,000 to purchase

- Generates $24,000 in gross annual rent

- Has $6,000 in annual operating expenses (excluding mortgage)

Step 1: Calculate Net Operating Income (NOI)

NOI = Gross Rent – Operating Expenses

= $24,000 – $6,000 = $18,000

Step 2: Divide NOI by Property Price

Cap Rate = NOI / Purchase Price

= $18,000 / $300,000 = 0.06 or 6%

Cash-on-Cash Return:

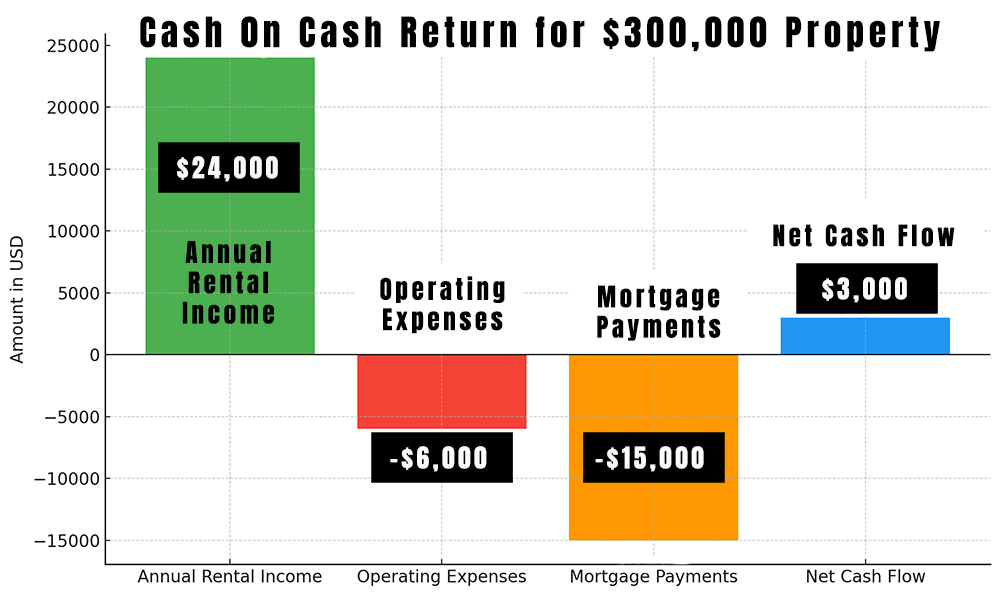

Measures the return on the actual cash invested (down payment, closing costs, etc.). This looks at the actual money you put forward to secure the property in relationship to what the property returns to you in the form of cash. Let’s assume we put down 20% of our $300,000 purchase price, that would be $60,000 as our down payment. This would leave us with an annual mortgage payment of $15,000 for our example.

Our cash-on-cash return is calculated by taking our gross annual income of $24,000 and subtracting out the operating expenses of $6,000 and subtracting our annual mortgage payments of $15,000, which leaves us with $3,000. We spent $60,000 to get a $3,000 return, so we take the $3,000 divided into our initial investment of $60,000 to get 0.05 or 5% cash on cash return. You can see that this is lower than our NOI because we now consider the cost of the mortgage payment.

Cash-on-Cash Return Example (Using $300,000 Purchase Price)

- Purchase Price: $300,000

- Down Payment (20%): $60,000

- Annual Rental Income: $24,000

- Annual Operating Expenses: $6,000

- Annual Mortgage Payments: $15,000

Step 1: Calculate Annual Cash Flow

Cash Flow = Rental Income – Operating Expenses – Mortgage Payments

= $24,000 – $6,000 – $15,000 = $3,000

Step 2: Apply the Formula

Cash-on-Cash Return = Annual Cash Flow / Cash Invested

= $3,000 / $60,000 = 0.05 or 5%

Gross Rent Multiplier (GRM):

The property price divided by gross annual gross rent. This is a fast way to screen deals by just looking at this number. Take the purchase price of $300,000 and divide it by the annual gross rent of $24,000, which gives us a Gross rent multiplier of 12.5, which means we are paying 12.5 times the annual gross rent for the property. A lower GRM generally suggests a better deal (all else equal).

Gross Rent Multiplier Example:

- Purchase Price: $300,000

- Monthly Rent: $2,000

- Annual Gross Rent: $2,000 × 12 = $24,000

Formula: GRM = Property Price / Annual Gross Rent

Calculation: $300,000 / $24,000 = 12.5

Net Operating Income (NOI):

This is the Gross income minus operating expenses (excluding mortgage payments) as we demonstrated before, which is the gross income of $24,000 minus the operating expense of $6,000 to give us $18,000 in net operating income.

Monthly Cash Flow:

This includes the rental income minus all expenses, including loan payments. Positive cash flow is essential, but breaking even can be acceptable if you have reserve cash for any additional unforeseen expenses, and you’re going for long term appreciation. Our monthly rental income was $2,000 with a monthly mortgage payment of $1,250, and let’s say monthly operating expenses of $500 for property taxes, insurance and maintenance. We would subtract all our expenses from our monthly income, which is $2,000 minus $1,250 for the mortgage minus $500 for the operating expenses for a $250 monthly cash flow. This adds up to a $3,000 per year positive cash flow.

In the next article we’ll cover the remaining strategies for analyzing single family homes for investment purposes.